Anúncios

Aproveite o financiamento com parcelas que cabem no seu orçamento e um carro novinho na garagem.

O financiamento de um carro pode ser o primeiro passo para transformar sua rotina e ganhar a liberdade de ir a qualquer lugar que você quiser, com total autonomia.

Imagine sair da concessionária com aquele cheiro de carro novo, sabendo que você fez um bom negócio e que vai pagar no seu próprio ritmo.

Se você também está pronto para essa etapa sem estresse ou surpresas, continue lendo e descubra tudo o que você precisa saber antes de financiar seu carro.

Aqui você encontra dicas práticas, vantagens reais e a maneira mais simples de fazer seu sonho caber no seu orçamento com segurança e confiança.

Descubra por que o Bradesco é a escolha inteligente para financiar seu próximo carro

Financiar um carro com o Bradesco significa mais do que conveniência — escolher um banco confiável e experiente, pronto para ajudar você a ganhar mobilidade.

Anúncios

Com suporte acessível e tecnologia intuitiva, o Bradesco simplifica e torna cada etapa, da simulação à contratação, mais fácil e transparente.

Em relação ao financiamento de automóveis, escolher um banco que misture tradição com inovação pode impactar seu orçamento e planejamento financeiro.

Agora você vai entender por que o Bradesco se tornou referência em financiamento sem complicações — e como isso pode beneficiar você diretamente.

Anúncios

As vantagens que tornam o financiamento de veículos do Bradesco imbatível

Financiar um carro com o Bradesco significa vantagens reais para quem busca praticidade, economia e liberdade na hora de escolher o veículo ideal.

Além de condições flexíveis, o banco oferece prazos longos, entradas opcionais e parcelas mensais que não sobrecarregam seu orçamento mensal.

O financiamento de veículos do Bradesco também inclui contratos digitais, simulações transparentes e acompanhamento personalizado durante todo o processo.

Essas características tornam o Bradesco imbatível para quem busca segurança, confiança e uma experiência tranquila na hora de comprar o carro ideal.

É possível financiar um carro com o Bradesco? Descubra agora!

Você pode ser mais elegível do que pensa ao considerar comprar um carro novo e optar por financiá-lo facilmente com o Bradesco.

O banco analisa cada caso cuidadosamente, considerando seu histórico, renda e possibilidades — sem padrões irreais ou burocracia excessiva.

O financiamento de veículos do Bradesco foi pensado para atender diferentes perfis, oferecendo soluções reais para quem busca um carro com tranquilidade.

Curioso para saber se hoje pode ser o seu dia? Continue lendo e descubra o que é preciso para começar sua jornada esta semana.

Como solicitar financiamento de carro com o Bradesco

Hoje em dia, financiar um carro com o Bradesco é muito mais simples do que você imagina, com opções acessíveis e serviços que facilitam a vida.

Você pode iniciar o processo diretamente do seu celular, usando o aplicativo do banco — não há filas, você tem total autonomia e instruções claras do início ao fim.

O financiamento do carro é concluído em poucas etapas, e você pode acompanhar tudo de casa, com total visibilidade e transparência.

Para quem prefere rapidez, também é possível ir até uma agência para atendimento presencial e soluções personalizadas de acordo com o seu perfil.

De carros a motos: tudo o que você pode financiar com o Bradesco

Você pode financiar um carro com o Bradesco, mas não para por aí. O banco também oferece financiamento para motos, caminhões e até veículos pesados.

Essa variedade ajuda todos a encontrar o modelo perfeito para deslocamentos na cidade ou para trabalhar com maior independência.

O financiamento de veículos abrange veículos novos e usados, com limite de idade e condições adaptadas às necessidades de cada cliente.

Até motos de alta cilindrada podem ser financiadas, com condições flexíveis e aprovação que se adaptam à evolução do seu estilo de vida.

Como obter as melhores taxas com o financiamento Bradesco

Muitas pessoas querem financiar um carro com o Bradesco, mas poucas sabem que pequenas ações podem melhorar muito os termos e taxas que você receberá.

Negociações inteligentes e simulações sólidas podem fazer uma grande diferença e mostrar ao banco que você é um cliente responsável e pronto.

O financiamento de automóveis melhora quando você entende como os juros funcionam — pontuação de crédito, entrada e outros fatores afetam seus resultados.

Fazer pequenas escolhas antecipadamente pode lhe poupar muito mais tarde, o que significa mais tranquilidade ao aproveitar seu carro com liberdade e conforto.

Como financiar seu carro sem entrada: é mais possível do que você imagina

É possível financiar um carro com o Bradesco mesmo sem ter uma quantia reservada para a entrada, e isso é mais comum do que você imagina.

O banco analisa cuidadosamente o seu perfil e oferece soluções que se adaptam ao seu momento, sem exigências excessivas ou sacrifícios.

O financiamento de carros com entrada zero depende de fatores como renda verificada e pontuação de crédito, mas está ao alcance de muitas pessoas.

Essa flexibilidade tem ajudado inúmeros brasileiros a adquirirem seus carros com mais rapidez, conforto e sem precisar esperar anos para dar a partida.

Procurando um carro usado? Veja como financiá-lo facilmente com o Bradesco

Se o seu objetivo é economizar e ainda assim permanecer livre, financiar um carro com o Bradesco pode ser a melhor maneira de adquirir um carro usado com facilidade e segurança.

O banco financia carros usados com até 17 anos de uso, oferecendo ótimas condições até para quem não tem interesse em modelos zero quilômetro.

O financiamento de carros usados cresceu porque permite parcelas mensais mais baixas e menos depreciação do que carros zero quilômetro.

Com o Bradesco, você alia praticidade, segurança e orçamento inteligente para levar o veículo perfeito para casa sem deixar seu plano para trás.

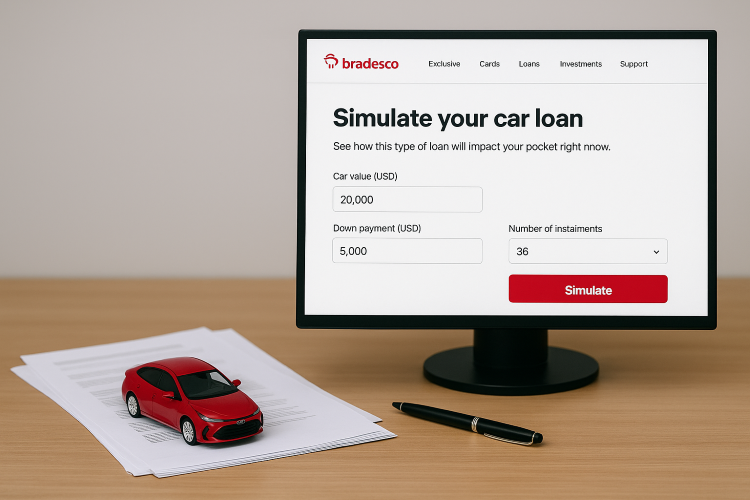

Como Simular o Financiamento do Seu Carro com o Bradesco

- Para simular seu financiamento, clique no “Acesse agora!” botão abaixo para ser redirecionado para a página oficial de simulação do Bradesco.

Site

Bradesco

- Lá, escolha o tipo de veículo que deseja financiar (carro, moto ou veículo pesado) e indique se é novo ou usado.

- Se você planeja oferecer um, preencha os campos com os detalhes do veículo, valor aproximado, prazo desejado e valor da entrada.

- Insira suas informações básicas, como CPF e renda, para que o simulador possa gerar opções que correspondam ao seu perfil financeiro.

- Revise os termos disponíveis, compare taxas e parcelas e salve os resultados para decidir com confiança na hora de se inscrever.

O que você precisa para ser aprovado: documentos e dicas inteligentes

Se você planeja financiar um carro com o Bradesco, certifique-se de que tudo esteja em ordem, principalmente os documentos essenciais que agilizam a aprovação.

Ter um cadastro limpo, comprovante de renda atualizado e dados pessoais corretos já facilita o caminho para receber o tão esperado "sim".

O financiamento de automóveis envolve uma análise de crédito que analisa seu histórico financeiro e capacidade de pagamento sem estourar seu orçamento.

Medidas simples como preparar sua papelada com antecedência podem aumentar suas chances de ser aprovado e sair dirigindo sem estresse.

Conclusão: Já Simulou? Então é Hora do Próximo Passo

Agora que você entende como o Bradesco facilita o processo, dar o primeiro passo em direção ao seu carro ficou muito mais simples.

Com planejamento inteligente, simulação clara e atenção às condições, seu objetivo se torna real e livre de surpresas desagradáveis.

Agora é a sua vez: simule seu financiamento com o Bradesco, aproveite as condições e comece hoje mesmo a dirigir o carro que você sempre quis!

Gostou? Quer mais uma ótima opção para financiar seu veículo? Confira o artigo abaixo e saiba mais sobre como financiar um carro com a BV Financeira!

Conteúdo recomendado